- Risk solver for excel full#

- Risk solver for excel pro#

- Risk solver for excel software#

- Risk solver for excel iso#

We’re DMCA-compliant and gladly to cooperation with you. We’re not straight affiliated with them.Īll trademarks, registered trademarks, product names and business names or logos that talked about in right here would be the assets of their respective owners. is definitely a windows app that developed by Palisade Corporation. When you click the “ Download” link on this web page, files will downloading straight in the owner sources (Official sites/Mirror Website). This App installation file is absolutely not hosted on our Server. Link: Risk Solver Alternative and Reviews Risk Solver provides Instant, interactive risk analysis in Excel, with lightning-fast simulations run each time you change a number.

Link: Comply Global Alternative and Reviews Risk Solver Contact us to streamline your compliance management.

Risk solver for excel software#

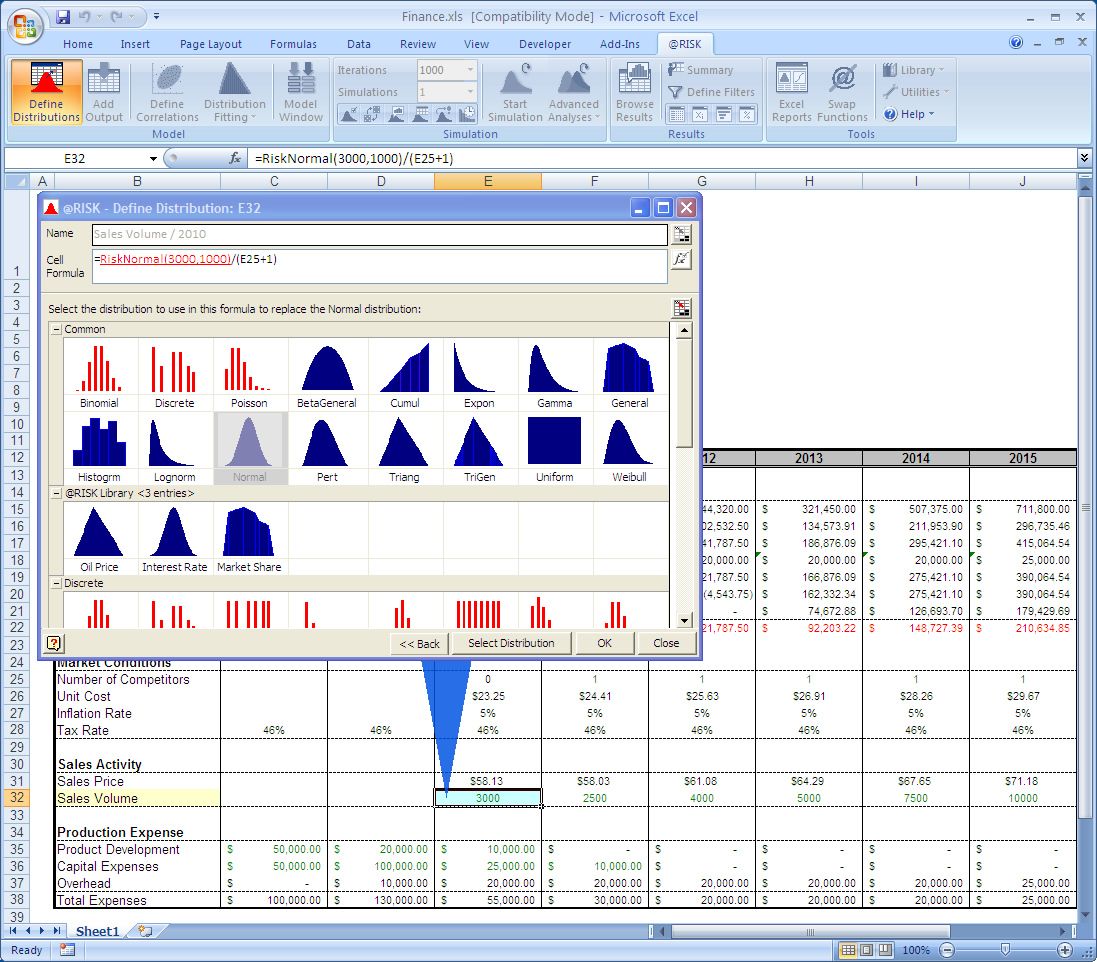

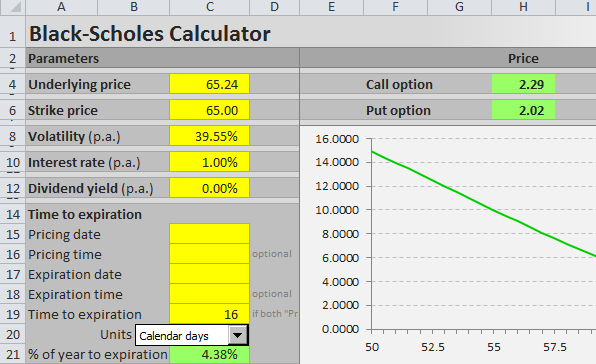

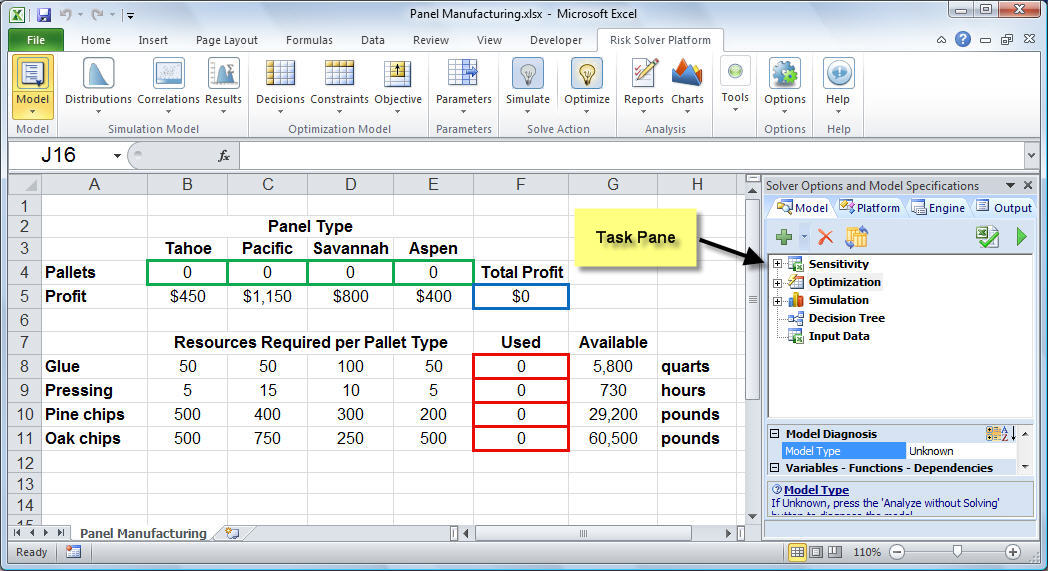

Link: Oracle Crystal Ball Alternative and Reviews Comply GlobalĬomplyGlobal is a cloud-based global compliance management software to manage your risks proactively. Use the Risk Solver App from Frontline Systems to perform risk analysis using Monte Carlo simulation in your. Oracle Crystal Ball is the leading spreadsheet-based application suite for predictive modeling, forecasting, simulation, and optimization. Decision-making software is reviewed separately. Link: ModelRisk Alternative and Reviews Oracle Crystal Ball It's feature set is extremely extensive, has been trying to match it for years. The World's most comprehensive risk analysis add-in to Excel. Check the 'Value Of' box, then enter a desired value. Select a cell to use from the 'Set Objective' field. Open a spreadsheet with data you want to analyze. Link: Invantive Control for Excel Alternative and Reviews ModelRisk Enable Solver in the 'Add-ins' section of your Excel preferences if necessary. Demand (production volume) is normally distributed with a mean of 1000 and standard deviation of 100 units. Outsourcing Decision Model, assume that two inputs are uncertain demand and unit cost. Example 11.3 Using Risk Solver Platform Probability Distribution Functions. The input and outcome of your risk models… Monte Carlo Simulation Using Risk Solver.

Risk solver for excel iso#

Invantive Control enables you to make decisions with Microsoft Excel and yet remain fully compliant with ISO 27002 and SAS 70. Make sure to select the app that fit with your Personal Computer Operating System. You can take one of this best alternative app for on below. For applications in pharmaceuticals, oil and gas, finance and insurance, and manufacturing quality control, this type of risk analysis is essential.Here we go, Alternatives and Similar Software.

Determine the annual rate of return and the total risk for the. Solve the model by Solver and determine the optimal allocation of investment fund among stocks, bonds, mutual funds, and cash.

Risk solver for excel full#

Move from simple average-best-worst case analysis to see the full range of possible outcomes, and quantify your downside risk and upside potential. Mutual Funds: Return (4) Risk (0.3) Cash: Return (1) Risk (0.0) Develop a linear programming model for a client with the maximum risk value of 0.18. Risk Solver Add-on helps you go beyond what-if analysis to perform realistic risk analysis. You can even step through the Monte Carlo trials and see each result calculated on your worksheet.

Risk solver for excel pro#

With the Risk Solver Add-on, you can perform risk analysis using Monte Carlo simulation in your Google spreadsheet using a subset of key features from our Risk Solver Pro product for Microsoft Excel.

0 kommentar(er)

0 kommentar(er)